Jumping into day trading for beginners 2024 can feel like a thrilling new challenge. You’re entering a space where stocks are bought and sold within minutes, and the potential for quick gains attracts thousands every year. If you’re eager to get started, you’re in good company!

But while the idea of financial independence is appealing, successful day trading requires more than enthusiasm—it calls for a solid plan, proven strategies, and the right tools to keep you on track.

This guide covers day trading strategies 2024 designed specifically for beginners, helping you make informed choices and avoid common mistakes. You’ll also find valuable beginner-day trading tips to guide you along the way. Toward the end, I’ll highlight some of the best tools for beginner day traders in 2024 to help set you up for success right from the start.

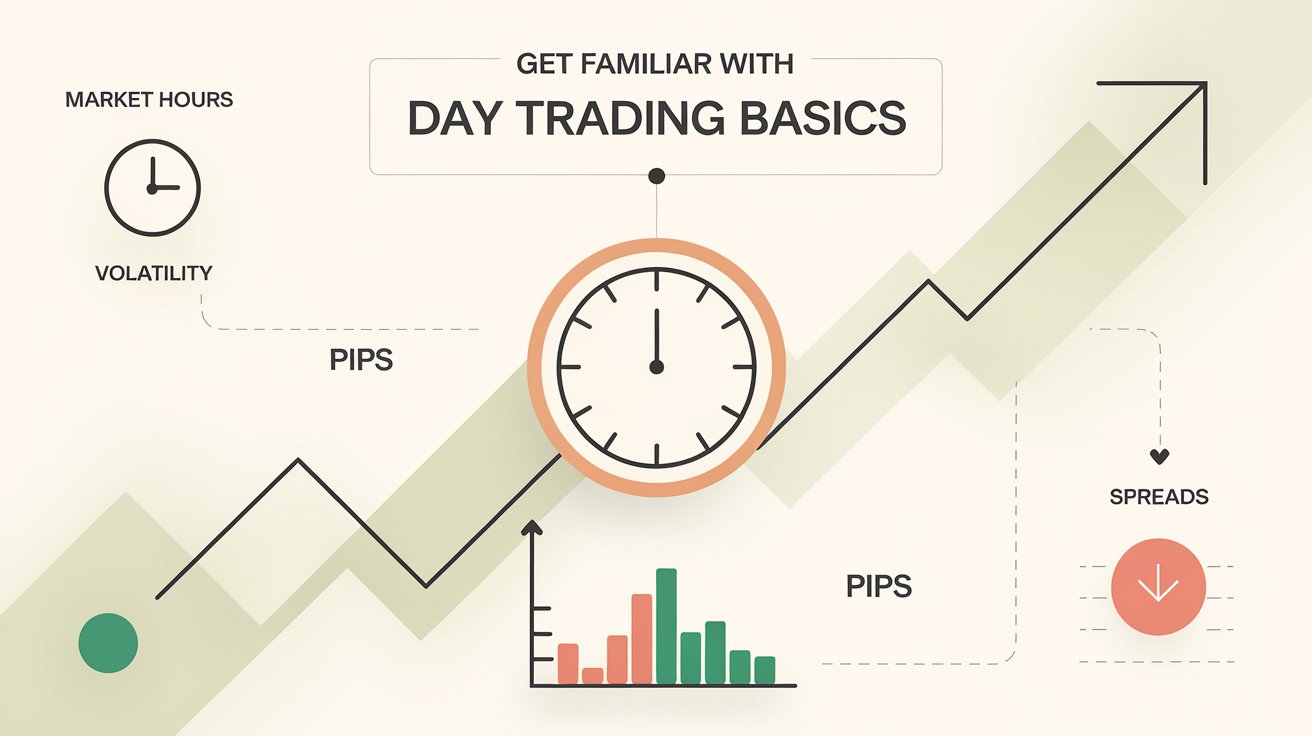

1. Get Familiar with Day Trading Basics

Wondering where to start with day trading for beginners in 2024? Let’s break it down. At its core, day trading means making several trades in one day, taking advantage of short-term price changes. But before jumping into specific strategies, it’s essential to grasp the basics.

- Know the Terms: Terms like “pips,” “spreads,” and “volatility” are essential in day trading. Understanding these helps you interpret market moves and make informed trading decisions.

- Research Market Hours: Different markets have peak trading times. Trading during these active hours can make day trading strategies 2024 more effective and open up better opportunities.

- Prepare for Volatility: The market’s ups and downs are part of the game. Being ready for sudden price shifts will help you stay calm and act wisely when trading.

- Practice Patience: While day trading requires quick actions, learning it takes time. Be patient, start small, and give yourself room to understand the process fully.

2. Choose the Right Day Trading Strategy for Your Goals

In day trading, there’s no one-size-fits-all approach. Understanding how to start day trading with the right strategy depends on your comfort with risk and what you want to achieve. Some strategies aim for high rewards with high risk, while others take a steadier, more cautious path.

Let’s look at a few popular day trading strategies 2024 that you might want to consider.

- Scalping: Ideal for those who enjoy quick trades, scalping focuses on capturing small price changes throughout the day. Each trade yields a small profit, adding up over time.

- Momentum Trading: Momentum trading involves buying stocks with strong upward movement and selling when the trend weakens. Timing is key—enter on the rise, exit before momentum fades.

- Breakout Strategy: This strategy focuses on trading when prices break through support or resistance levels, signaling a potential new trend. Catching breakouts early can lead to solid gains.

- Range Trading: For a steadier approach, range trading involves buying low and selling high within a defined price range. It works best in stable markets with limited volatility.

Take time to find a strategy that aligns with your style. Start by testing it with a demo account so you can practice without risking real money. This way, you’ll be able to build confidence and get a feel for the strategy that fits you best.

3. Equip Yourself with the Best Tools for Day Trading Strategies 2024

Day trading success isn’t just about picking the right strategy; it’s about having the right tools in your corner. The best tools for beginner-day traders in 2024 make it easier to spot trends, manage trades, and make decisions that matter. Think of these tools as your trading toolkit—they can give you a real edge.

Here’s a look at what you’ll need to get started.

- Charting Software: Real-time charting software helps you track price movements and spot trends. Customizable indicators make it easier to analyze patterns and plan your trades with confidence.

- Stock Screeners: Screeners filter stocks by criteria like price, volume, and volatility, saving you time and helping you focus on potential trades that align with your strategy.

- Trading Platform: Choose a platform with fast trade execution, low fees, and good educational resources. Following beginner-day trading tips, look for a beginner-friendly interface to make trading smoother and less intimidating.

- News Feeds: Real-time news keeps you updated on events that impact stock prices, helping you react quickly to earnings reports, economic updates, and policy changes.

4. Mastering Timing: When to Trade and When to Wait

When you’re just starting with day trading, learning the right timing alongside effective day trading strategies 2024 can make all the difference. Knowing when to dive in—and when to hold back—can be the deciding factor between profit and loss.

Here’s how timing can impact your trading journey.

- Focus on Opening Hours: The first hour after the market opens is often packed with activity, creating big swings in prices. Many traders call this the “rush hour” of the market, and it’s a key time to watch for quick profit opportunities.

- Watch for Major Events: Earnings reports, economic data, and global news can shake up the markets. By keeping an eye on these events, you can anticipate major moves, giving you a clearer sense of when to act.

- Set Alerts: If you’re new to day trading for beginners 2024, alerts are your best friend. Setting alerts on your trading platform helps you track significant price changes or news events, so you’re ready to act without constant screen-watching.

- End-of-Day Trends: The last hour of trading can bring sharp movements as traders wrap up their positions for the day. Watching this final stretch can uncover some interesting opportunities, especially if you like to close out all trades by day’s end.

5. Solid Risk Management Tips for Day Trading for Beginners 2024

For anyone starting in day trading for beginners 2024, one of the best moves you can make is to prioritize risk management. Even the most effective strategies can’t always shield you from losses, but smart risk management can help protect your capital and keep you trading for the long haul.

Here’s how to stay on the safe side:

- Use Stop-Loss Orders: Think of stop-loss orders as your safety net. Setting a stop-loss automatically sells your position when it hits a specific price, keeping losses in check. This way, you avoid the stress of constantly monitoring and can trust that your risk is managed.

- Set Daily Limits: Before each trading day, decide the maximum amount you’re willing to lose. A daily limit helps keep emotions steady and supports your day trading strategies 2024, preventing the urge to chase losses, which can lead to bigger problems. Once you reach your limit, step away—you’ll be better prepared for the next day.

- Limit Trade Sizes: Starting small can go a long way in protecting your account. Large trades right off the bat can lead to quick, heavy losses. By starting with smaller trades, you manage risk better and build your skills without overexposing yourself.

- Diversify Your Trades: Don’t rely on a single stock or sector. Spread your trades across different stocks or areas to protect yourself from unpredictable swings. Diversifying cushions the impact of one trade on your overall capital, giving you a more balanced approach.

6.Manage Your Emotions to Stay Focused

Keeping your emotions in check is crucial for day trading for beginners 2024 and is often overlooked. Trading can be intense, and emotions like fear, excitement, or frustration can cloud your judgment, leading to hasty decisions that may cost you. Learning to manage emotions helps you make smarter choices and stay aligned with your goals.

- Stick to Your Plan: Having a plan in place is essential, but sticking to it is where the challenge lies. Fear and excitement can easily tempt you to go off-course, but staying committed to your strategy helps you avoid impulsive trades. Remind yourself that consistency often wins over gut reactions.

- Avoid Revenge Trading: After a loss, it’s natural to want to jump back in to “win it back,” but this approach often leads to deeper losses. Revenge trading can cloud your judgment and turn minor setbacks into bigger issues. Instead, take a step back, regroup, and wait for the next solid opportunity.

- Take Breaks: Day trading can be intense, especially when you’re learning how to start day trading, so give yourself regular breaks to clear your mind. Stepping away from the screen, even just for a few minutes, can refresh your perspective and help you make better decisions when you return.

- Reflect on Your Performance: After a trading session, take a few moments to review your trades. Look at what worked, what didn’t, and why. Reflecting on both wins and losses helps you learn from experience, build confidence, and improve your approach over time.

- Stay Calm During Market Swings: Markets fluctuate, sometimes dramatically, and it’s easy to feel anxious. Remember that ups and downs are part of trading. Stay calm, focus on your plan, and don’t let short-term changes affect your long-term goals.

- Celebrate Small Wins: Trading isn’t just about big wins. Acknowledge and celebrate the small successes along the way. Recognizing your progress, no matter how minor, can keep you motivated and remind you that you’re improving with every trade.

Conclusion

Starting with day trading for beginners 2024 can feel like a big leap, but with the right strategies and tools, you are set up to build strong skills and see steady progress. Focusing on a clear strategy, choosing the best tools for beginner-day traders in 2024, and following key beginner-day trading tips will lay a solid foundation for success. Patience, discipline, and a willingness to keep learning are your best allies on this journey.

Whether your goal is to make quick profits or to develop day trading as a long-term skill, these strategies can guide you toward reaching your trading ambitions in 2024 and beyond.

Ready to get started? Dive in, stay focused, and let your trading journey begin—success is just trade away!

FAQs

What is day trading for beginners in 2024?

Day trading for beginners in 2024 refers to buying and selling financial instruments within the same day. It’s a popular approach for those looking to make quick profits, although it requires knowledge, strategy, and patience to succeed.

What are the best day trading strategies for 2024?

Some of the best strategies for 2024 include scalping, momentum trading, breakout strategies, and range trading. Each strategy has its unique benefits and is suited to different risk tolerances.

How do I choose a day trading strategy in 2024?

Choosing a day trading strategy in 2024 depends on your risk tolerance, goals, and market understanding. Beginners may benefit from testing strategies in a demo account to find what works best before investing real money.

What are essential beginner-day trading tips?

Key beginner tips include having a clear strategy, using stop-loss orders, managing risk, taking breaks, and learning to control emotions. These tips help keep new traders focused and disciplined.

How much capital do I need to start day trading in 2024?

The capital needed to start day trading in 2024 varies by market and trading style. While some start with $500-$1,000, the general recommendation is to have enough to cover potential losses while still meeting your trading goals.

What are the best tools for beginner day traders in 2024?

The best tools for beginner day traders in 2024 include charting software, stock screeners, reliable trading platforms, and real-time news feeds. These tools support informed decision-making and efficient trade execution.

How can I find the best day trading strategies for beginners?

For beginners, some of the best day trading strategies include scalping and range trading. These strategies allow new traders to practice discipline and learn the basics of market trends with manageable risks.

What’s the difference between day trading and swing trading for beginners?

Day trading involves closing all positions by the end of the day, while swing trading involves holding trades over several days. Beginners often find day trading more appealing due to the quicker results, though both require practice and planning.

How can I control my emotions while day trading?

Emotions can lead to impulsive decisions in day trading. To manage them, follow a solid strategy, set stop-loss orders, take regular breaks, and review trades to learn from past experiences. Mastering emotions is a vital part of beginner-day trading tips.

Why is risk management important in day trading for beginners in 2024?

Risk management is crucial because it helps beginners avoid significant losses. By setting stop-losses, limiting trade sizes, and diversifying, new traders can protect their capital and build confidence gradually.