Starting with the stock market can feel like stepping into a maze without a map. The amount of information can be overwhelming and might make you wonder if it’s worth the effort. The financial world is full of jargon and strategies that can leave you puzzled. However, mastering stock market basics for beginners can help you make informed choices and build a strong foundation for success. With the right approach and continuous learning, even newcomers can confidently enter the world of stock investing.

Talking about how to invest in stocks for beginners might feel like wading through an ocean of information at first, but don’t let that intimidate you. By focusing on fundamental knowledge, setting clear goals, and adopting strategic practices, you can start building a solid investment foundation with confidence. Here are seven essential tips to guide you on your path.

1. Set Clear Financial Goals

Setting clear financial goals helps you stay focused on why you’re investing. A well-structured approach forms the foundation for beginner stock investing strategies that align with your objectives. Whether saving for retirement, funding your child’s education, or growing your wealth, understanding your goals will shape your investment strategy.

Knowing exactly what you want to achieve can prevent you from making impulsive decisions that could derail your progress. Setting specific, measurable, and realistic objectives can keep you on track and motivated.

- Identify your investment horizon (short-term or long-term).

- Define how much risk you’re comfortable taking and adjust your strategy as needed.

- Establish a budget for your investments to ensure financial stability without impacting daily expenses.

- Decide whether you want to invest actively or passively to align with your goals and lifestyle.

2. Educate Yourself on Stock Market Basics for Beginners

To truly grasp stock market basics for beginners, you need to learn about the various types of stocks and investment strategies. Stocks can be categorized based on market capitalization, sectors, or growth potential. Understanding these differences helps in building a balanced portfolio and avoiding unnecessary risks.

- Blue-chip stocks: Large, reputable companies with a history of reliability and consistent returns, making them safer choices for beginners.

- Growth stocks: Companies are expected to grow at an above-average rate, often reinvesting earnings back into the business. These can be riskier but offer high potential returns.

- Dividend stocks: Offer regular income through dividends, ideal for those seeking steady returns alongside capital appreciation.

- Index funds and ETFs: Diversified options that track a specific index, providing stability and broad market exposure to reduce risk while simplifying investment decisions.

3. Start Small and Diversify

One of the best stock market tips for beginners is to start small and diversify your investments. Avoid putting all your money into one stock; instead, spread your investments across various industries and asset classes to minimize risk. Diversification can shield you from market volatility and offer more consistent returns.

- Begin with a modest investment to get a feel for the market and learn the basics without significant financial exposure.

- Diversify across different sectors like technology, healthcare, and finance to balance your portfolio and hedge against sector-specific downturns.

- Include domestic and international stocks to broaden your exposure and benefit from global market growth.

- Consider mutual funds or ETFs for instant diversification and a safer start to your investment journey.

4. Develop a Solid Investment Plan

A well-thought-out investment plan helps you stay disciplined and avoid emotional decision-making. How to invest in stocks for beginners can provide the structure needed for a successful strategy. A logical strategy makes it easier to stay on track, especially during market fluctuations. A solid plan acts as a roadmap, guiding investment choices and enabling long-term success.

- Choose a mix of stocks that align with your risk tolerance and financial goals, ensuring a balanced approach.

- Reinvest dividends to maximize growth over time and take the benefits of compounding, which can significantly boost returns.

- Set automatic contributions to build consistency and reduce the temptation to time the market, which is often challenging even for experts.

- Regularly review and adjust your portfolio based on performance and market conditions, ensuring it remains aligned with your goals.

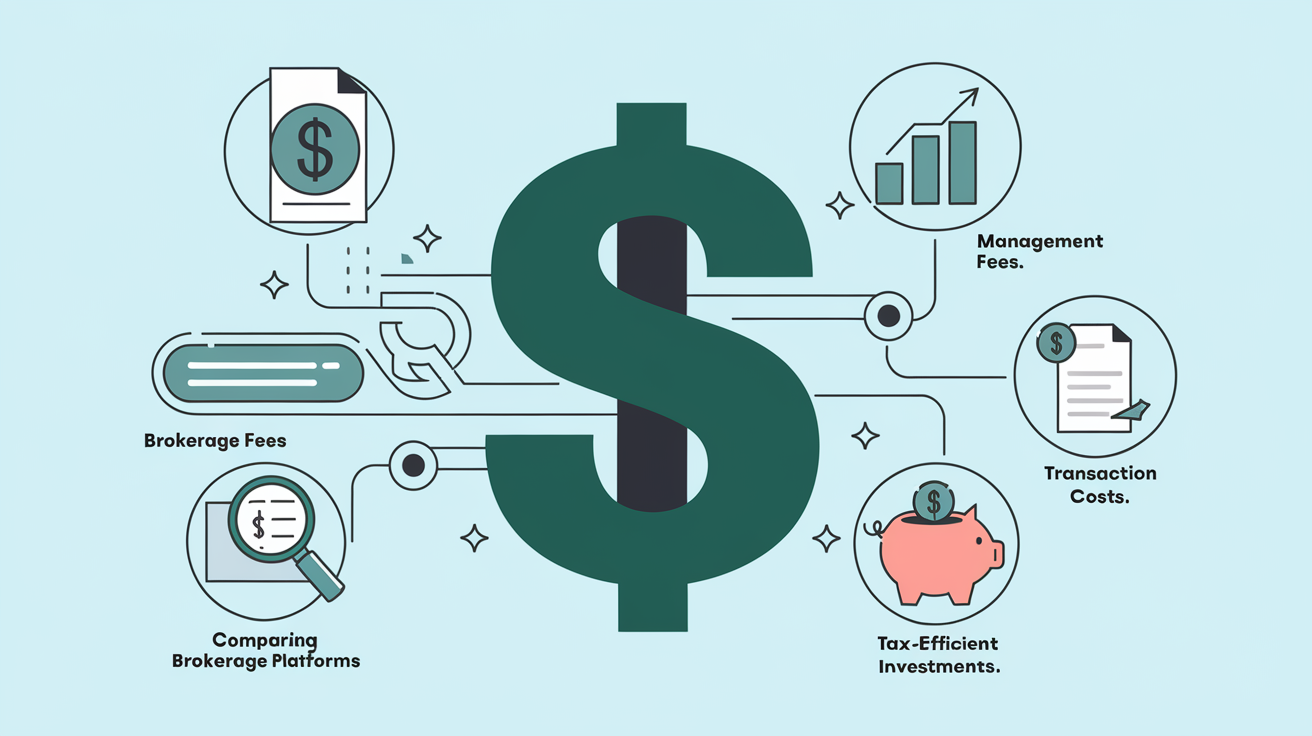

5. Be Mindful of Investment Costs

Costs can erode your returns over time, so understanding fees is essential. These can include brokerage fees, management fees, and transaction costs. Learning how to invest in stocks for beginners often involves finding cost-effective solutions. Lowering these costs can significantly improve your long-term gains and overall return on investment.

- Compare different brokerage platforms for their fee structures, ensuring you pick one that aligns with your investment habits and frequency.

- Look for no-commission trading options that can save you money on frequent transactions, especially if you plan to trade often.

- Be aware of management fees associated with mutual funds and consider low-cost index funds or ETFs for better value.

- Choose tax-efficient investments, when possible, to maximize net returns and retain more of your profits.

6. Stay Patient and Keep Learning

Investing isn’t a get-rich-quick scheme. Practicing beginner stock investing strategies requires patience and ongoing education. The more you learn, the better equipped you will be to make wise decisions. Staying committed to continuous improvement can enhance your investment outcomes and confidence.

- Read reliable investment guides, financial books, and reputable articles to deepen your understanding of market dynamics.

- Follow financial news and market updates to stay informed and react appropriately to changes in the economic landscape.

- Stay updated on economic trends and their potential impact on stocks, which can provide insights into future opportunities.

- Learn from your mistakes and refine your strategies to improve your approach, turning challenges into valuable learning experiences.

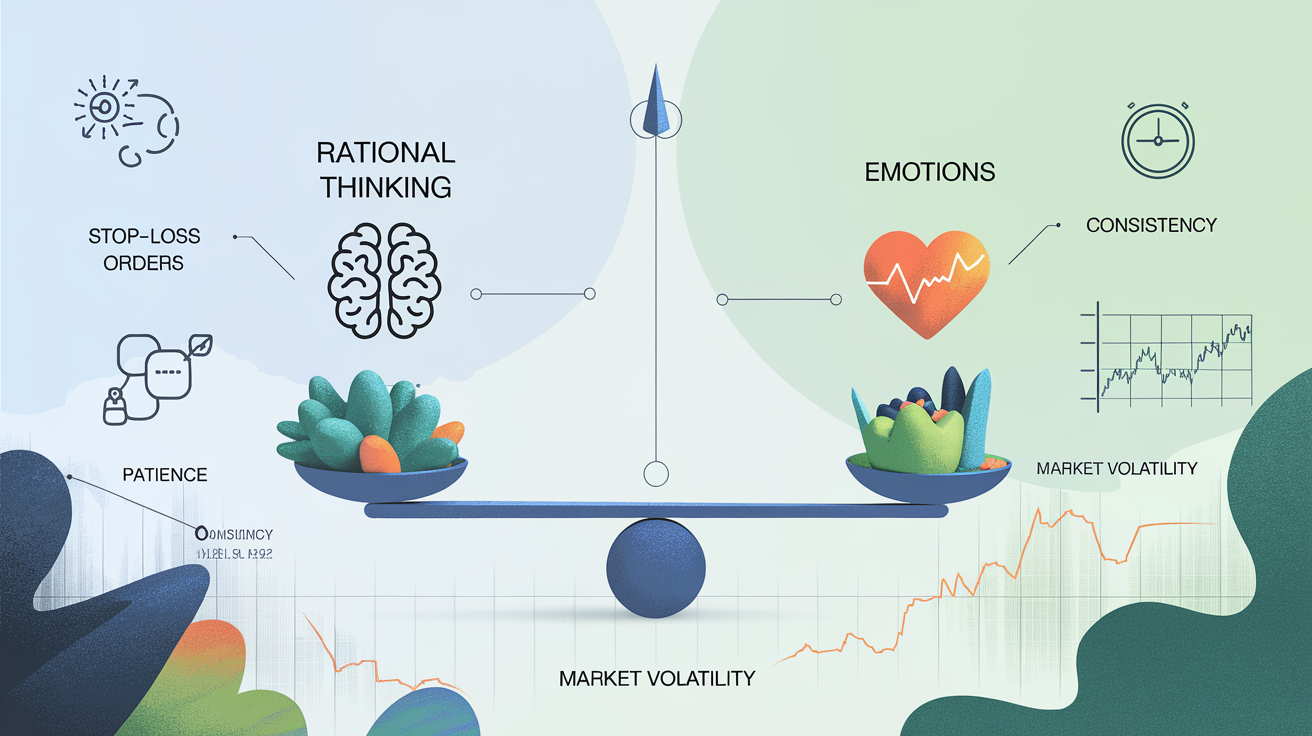

7. Manage Your Emotions with Stock Market Basics for Beginners

An often overlooked but critical stock market tip for beginners is to manage emotions while investing. The stock market can be volatile, and emotional decisions can lead to poor outcomes. Keeping a level head and sticking to your plan is essential for long-term success. Emotional stability can help you navigate market highs and lows with a clear mindset.

- Avoid making impulsive decisions during market fluctuations, as these often lead to preventable losses.

- Don’t let fear or greed drive your choices; maintaining a balanced perspective helps you stay objective and focused on your strategy.

- Use tools like stop-loss orders to protect your investments and limit potential losses, which can provide peace of mind.

- Remember that consistency and adherence to your strategy often win over emotional reactions and hasty choices, contributing to better outcomes.

Additional Stock Market Tips for Beginners

To strengthen your grasp of stock market basics for beginners, consider practicing with simulated trading platforms. These tools allow you to make virtual investments without real financial risk, helping you understand market trends and practice decision-making. Engaging in community discussions and forums can also provide insights and answers to questions you may have as you begin investing.

- Use a stock market simulator to gain hands-on experience and build confidence before investing real money.

- Participate in investment workshops or online courses to expand your knowledge and learn from seasoned experts.

- Network with other beginner investors to share knowledge, tips, and lessons learned, fostering mutual growth.

- Keep a journal to track investment decisions, reasoning, and outcomes for future reference and strategy improvement.

Staying informed is key when learning how to invest in stocks for beginners. It’s helpful to set aside regular time to review your portfolio and read up on current market conditions. Consistent learning and adaptation can build your confidence and improve your investment strategies.

Conclusion

Starting with stock market basics for beginners doesn’t have to be overwhelming. Follow the above-listed seven key tips to begin your journey confidently and gradually build your investment knowledge. With patience, discipline, and continuous learning, investing in the stock market can become a powerful tool for achieving your financial goals.

FAQs

What are the stock market basics for beginners?

Stock market basics involve understanding how stocks work, the types of stocks, and basic investment principles.

How can I get started with the stock market?

Begin by educating yourself on investment strategies, setting clear goals, and choosing a brokerage that fits your needs.

What are some beginner stock investing strategies?

Strategies include diversifying your investments, starting small, and focusing on long-term growth.

Why is learning how to invest in stocks for beginners important?

It helps create a foundation for making informed decisions and avoiding common pitfalls.

What stock market tips for beginners should I follow?

Start with a clear plan, stay patient, and continue learning to adapt to market changes.

Is there a stock market guide for beginners I should read?

Yes, there are many reputable guides available online and in bookstores that cover essential topics for beginners.

How do I choose the best beginner stock investing strategies?

Assess your financial goals and risk tolerance to select strategies that align with your objectives.

What should I know before getting started with the stock market?

Understand market trends, investment options, and diversifying your portfolio.

Are there specific stock market basics for beginners I should master first?

Yes, start with learning about different types of stocks, how to read stock charts and fundamental analysis.

What are the initial steps for learning stock market basics for beginners?

Start by reading investment books, attending workshops, and using stock simulators to practice without financial risk.